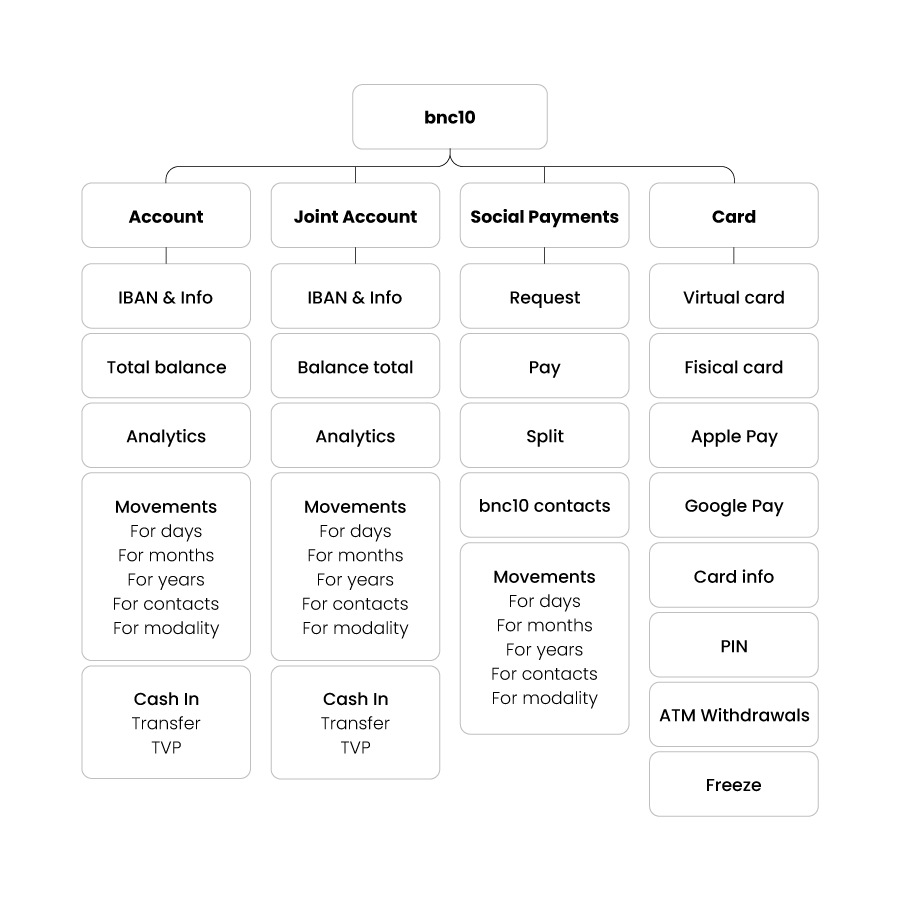

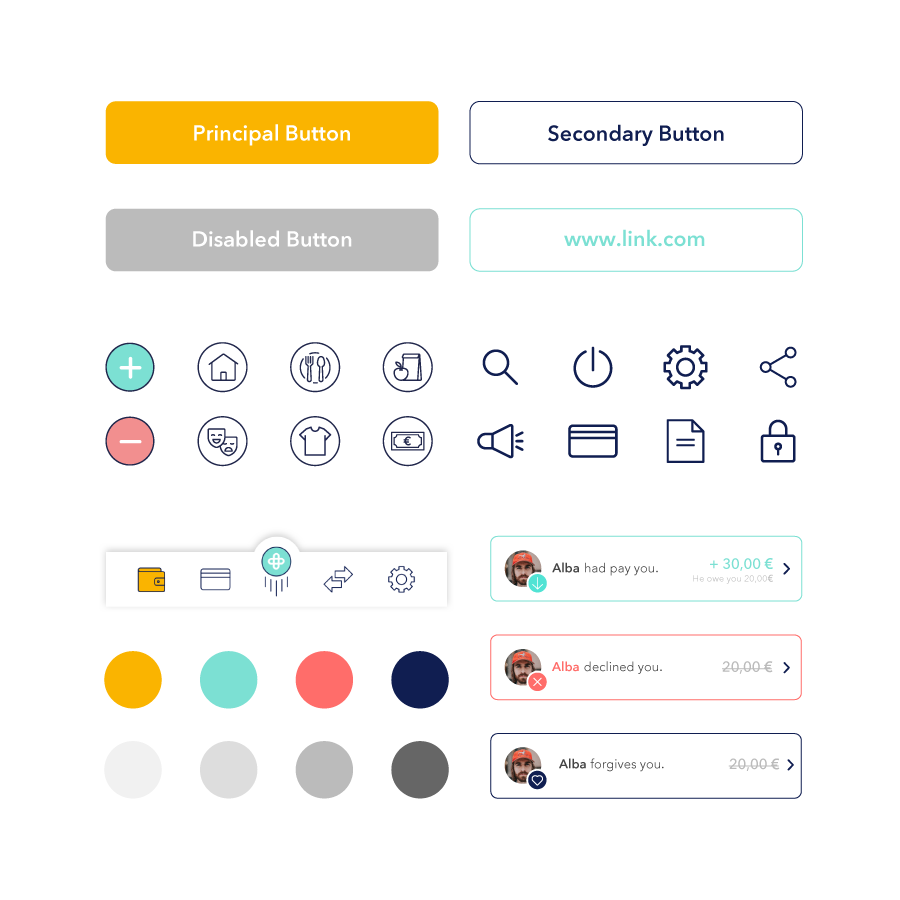

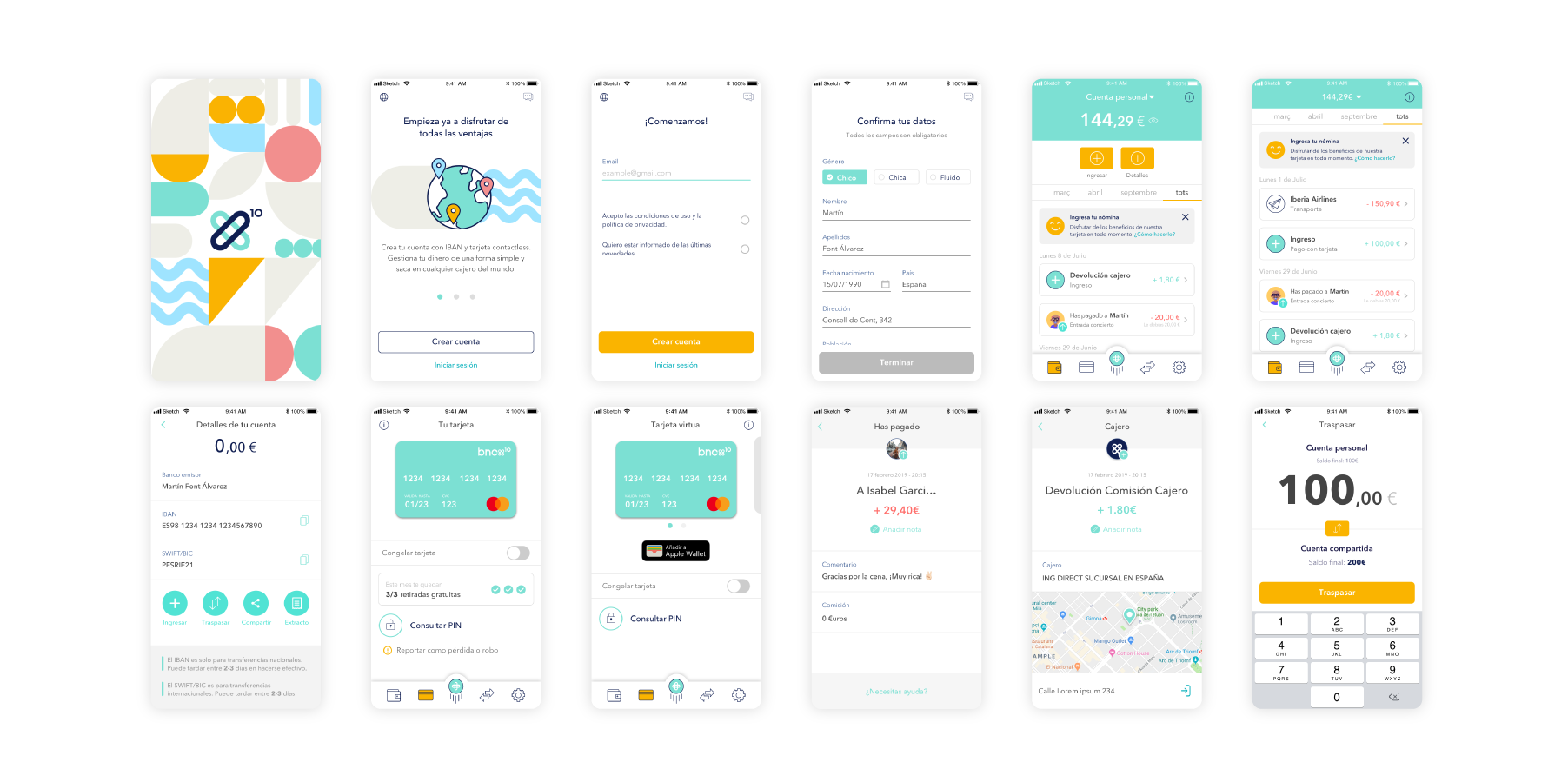

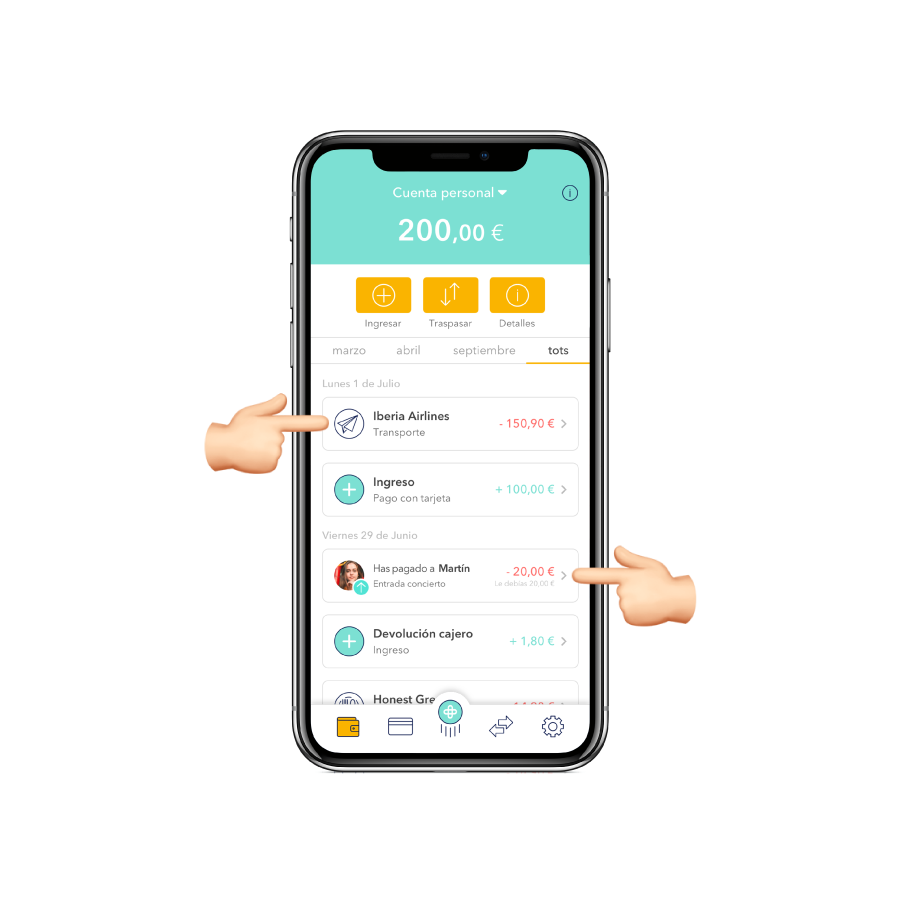

Bnc10 neobanking

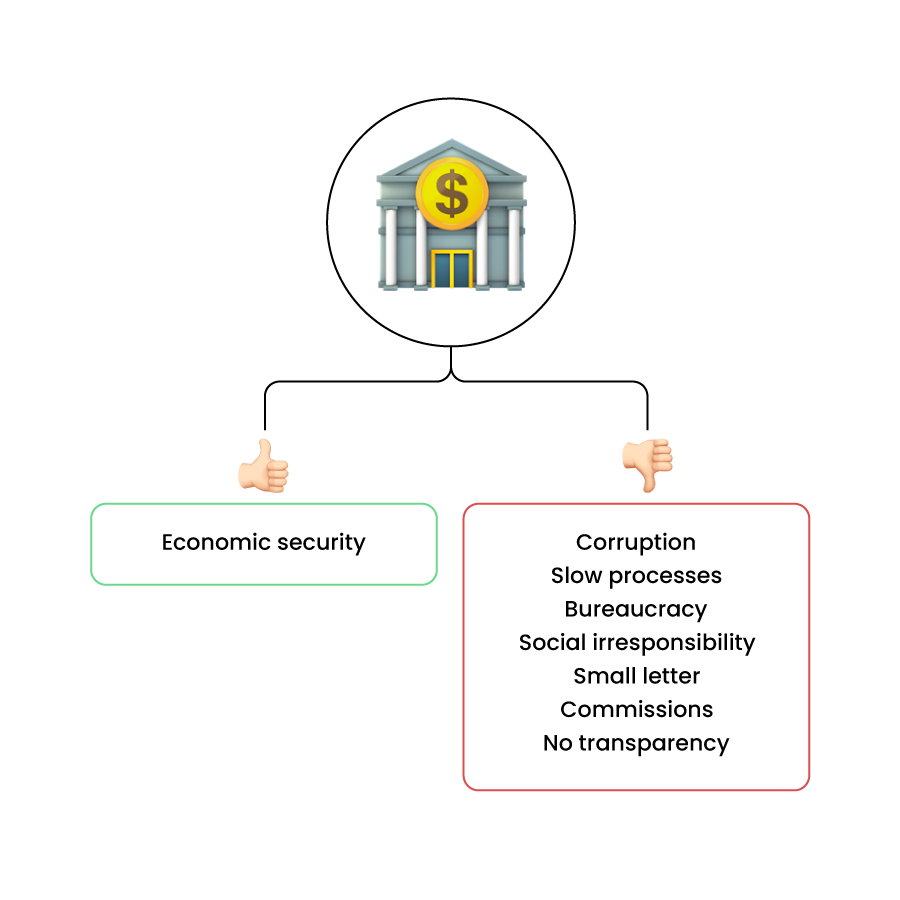

Bnc10 is a new banking concept that aims at offering their users a new experience when managing their money.

Created in Barcelona, it was envisioned with the intention to revolutionise the current banking system by bringing an intuitive, transparent and cool vision.